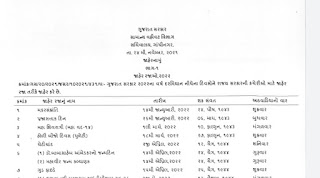

Gujarat State announces year 2022 public holidays, list of optional holidays

It is reported that the Bitcoin is rolling into forbidden grounds as it creates a spate of controversy among the "high" society and savvy digital investors. These digital marketers try to gain their share of the billion-dollar-a-day digital pie while corporate society seeks to curtail the spiral hike in the value of what seems to be a "monetary menace". Some who strive on exploiting the poor and vulnerable are not having this as they try to inoculate the masses in an attempt to put down this growing "digital monster."

These seemingly corporate crooks continue to put a choke-hold on how the less fortunate spend their money as they try to build financial cartels worldwide but thanks to digital technology, Bitcoins have revolutionized money control in the 21st!

The Cons

Despite the growth of digital currencies such as Bitcoins, it would be remiss of me to not disclose the cons of these virtual currencies. Due to the fact that their digital footprints are encrypted, they cannot be traced online. Although one has the pleasure of privacy and security when trading, it provides another gateway to hide and conduct illicit transactions.

When this happens, drug dealers, terrorist and other suspected culprits, will continue to conduct their illicit trade without detection when using Bitcoins.

The Pros

However, amidst the monetary mayhem, Bitcoins offer anyone tremendous investment opportunities and growth potential. No one controls virtual currency as it can be accessed by the public in cyberspace and the value continues to appreciate while the society stumbles on the debris of inflation.

An ordinary man on the streets can buy, save, trade, invest and increase his chances of becoming financially successful without the interference of government restrictions, controls, and fiduciary regulations; hence spiral inflations become things of the past.

Many truly believe the number 1 problem in our society is establishing financial monopolies. When one corporation decides to control foreign exchange, gold, and fuel, it uses its power to dictate how money should be spent.

Regulations set by large and wealthy multi-corporations are only geared to add more wealth and power to their portfolio rather than benefiting borrowers who seek financial help. In addition, the ones at the top try to drain the swamp so others can depend on them while they can become wealthier but they can't control digital currency!

The Brighter Side of the Coin

Time has come to open the eyes of the world and that is what Bitcoin is all about. The ones who try to control the world are threatened by this Frankenstein but I doubt they can stop it or call the shots. Currently, 1 Bitcoin values $844099.07 Jamaican Dollar or $6895.80 US Dollar. The cost for 1 Bitcoin in 2009 was.05 USD!

CLICK HERE TO DOWNLOAD PDF FILE HD PRINT

Read more our Article :-

Read more :- DAY 2 DAY AAYOJAN SEM 2 USEFULL TO ALL TEACHERS

ADHYAN NISPATI DOWNLOAD 2ND SEM CLICK HERE

A Guide On How To Understand Bitcoin And Cryptocurrency?

ડીસેમ્બર-2021 ની મરજીયાત રજા જોવા માટે.

મરજીયાત રજા જોવા અહીં ક્લિક કરો

Even though Bitcoin is one of the most searched for terms (according to Google), it is a very technical subject for a lot of people and can get overly technical for non geeks. However, there are now hundreds of cryptocurrencies and more and more people are starting to want to get to know how they work possibly driven by a dis trust of bankers, which is a whole different discussion.

It is difficult to get a lay man's explanation without having to use technical terms such as "secret keys", "digital keys", "digital wallet" and "cryptocurrency" so I will do my best to keep things as straight forward as I possibly can.

Read more :-

The Concept of Fiat money i.e. paper currency, was formulated to make it simpler for people to make an exchange for goods or services to replace bartering, as this would be limited to an exchange between two willing parties at best, whereas money allows you to provide your service or goods, then purchase whatever service or goods you require from another or others.

Therefore, I would argue that Bitcoin is the 21st Century equivalent to bartering, in that it works as an exchange for goods or services directly between two willing parties. Bartering had to be based on each promise and trust, to provide and deliver the promised goods or service.

Today with Bitcoin or any other cryptocurrency each party would need a unique file or unique key to exchange the agreed value between each other.

By having a unique key or file it becomes easier to keep a record on each transaction. However, this too comes with problems.

Now, bartering is the simple exchange of skills or goods as I have already stated, the modern equivalent, or bitcoin is susceptible to security breaches, i.e. theft or hacking of files, this is where a "cryptocurrency wallet" comes into the equation to secure your transactions.

Basically you need a secure location for your cryptocurrency/bitcoin purchases and holdings. This is where the need for a hardware wallet comes from.

So now that you have written down/recorded which address holds which amount of Bitcoins and then updated every time a transaction is made, the file is known as "The blockchain" - and it keeps a record of all transactions made with bitcoin.

📢🆕કોવિડ સહાય દસ દિવસમાં મળવાપાત્ર લેટેસ્ટ પરિપત્ર ડાઉનલોડ કરવા અહીં ક્લિક કરો

Post a Comment